A market stall in Madrid, Spain. Analysts digest the latest inflation numbers outside the euro zone.

Europe Press News | Europa Press | Good pictures

Inflation in the euro zone eased significantly in March as energy prices continued to fall, while core spending hit an all-time high.

Core inflation for the 20-member bloc was 6.9% in March, according to preliminary Eurostat figures released on Friday. In comparison, in FebruaryHeadline inflation was 8.5%.

The main reason for this 1.6 percentage point drop was the drop in energy costs.

However, other parts of the inflation basket remain stubbornly high. Food prices contributed heavily to March’s overall inflation measure.

Core inflation – excluding volatile energy, food, alcohol and tobacco prices – rose slightly from the previous month. It reached an all-time high of 5.7% In March, it was 5.6% in February.

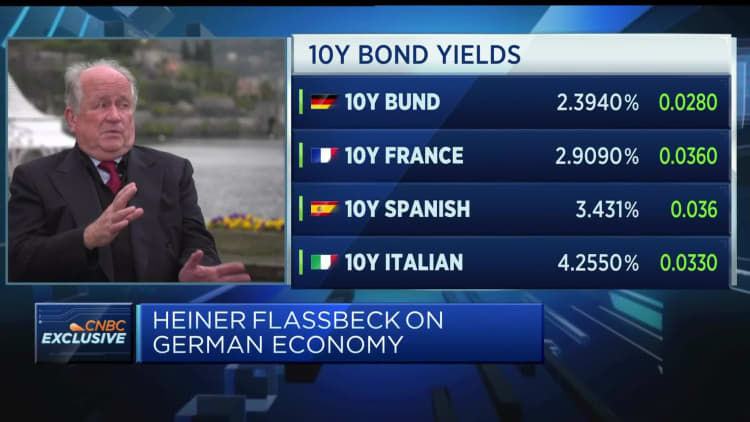

Interest rates at a glance

These statistics do not provide strong enough evidence The European Central Bank may pause its rate hike cycle that began in July.

“Policymakers at the ECB will not read too much into the fall in inflation in March and will be more concerned with the key rate hitting a new record,” said Jack Allen-Reynolds, deputy chief eurozone economist at Capital Economics. In a note on Friday.

He said the ECB would keep raising rates even as the headline numbers eased.

ECB member Isabel Schnabel made the headlines on Thursday inflammation Started to ease, but core inflation is proving sticky.

Although last year’s energy price increases spread rapidly across the economy, they are taking a long time to dissipate, and it’s not even clear whether it’s going to be completely symmetrical, meaning everything is going to drop. An event on Thursday, according to Reuters.

The ECB raised rates by 50 basis points in March, bringing its key benchmark rate to 3%. However, it gave no indication of possible rate decisions in the coming months.

The recent banking turmoil has raised questions about whether central banks are being too aggressive in moving interest rates to tackle inflation. ECB Chief Economist Philip Lane said that more interest rate hikes would be needed to counter higher inflation if instability in the bank were to ease.